Thematic Investing

Our Investment Approach

57 Stars’ thematic investment approach derives from rigorous internal assessment of investment traits that have historically performed well, coupled with our ability to capitalize on our scale, brand, and market positioning to drive proprietary deal flow. We have identified these sectors and transaction types to have attributes that lead to positioning our fund portfolios for outperformance.

A thematic transaction offers attributes that enhance the clarity and conviction of an investment by identifying an asset, portfolio of assets, or distinct sector opportunity on which deal teams can perform due diligence. Such transactions capitalize on the Team’s investment underwriting acumen while also providing detailed insight into the investment process, including sourcing networks, deal structuring and investment skills of the GP leading the transaction.

Areas of Sector Focus

Within the target geographies in which 57 Stars invests, there are key sectors that are disproportionately benefiting from secular tailwinds driving consumer-led growth, oftentimes expanding at a multiple of GDP. We have identified five broad sectors in which to focus our investment efforts.

Healthcare

Enterprise

Demographic growth and rising incomes drive demand for healthcare, tech innovations in service delivery, and analysis and drug R&D processes

- Innovative & Generic Pharma

- Biotech & Medical Devices

- Service Providers

- Digital Health & Wellness

- Tele-Medicine / Diagnostics

- Med-tech /Health SaaS

Tech-Enablement

Consumer

Mobile adoption, social media, and sophisticated logistical solutions expand new channels to reach consumers

- E-Commerce & Retail

- Marketplaces & Sharing Economy

- Logistics & Consumption Enablers

- Tech-Driven Consumption

- Media & Digital Content

- B2B & B2C Services

Tech-Enablement

Enterprise

Cloud technology and SaaS fuel demand across multiple business sectors to improve security, compliance and to create competitive advantage

- Software-As-A-Service

- Connectivity Platforms

- Artifical Intelligence

- Cloud Services

- Data Analytics

- Enterprise Software

Fintech & Financial

Services

Consumer

Adaption of digital technologies fosters low-cost financial solutions using data to circumvent information asymmetries

- Payments: Digital, P2P, POS

- Consumer & MSME Credit

- Insurance & InsurTech

- Digital Banking

- Wealth Management

- Financial SaaS

Environmental Sustainability

Consumer

Technological innovation is rewriting how we manage our carbon footprint and drive resource efficiency

- Clean Energy

- Resource Efficiency

- Agribusiness

- Sustainable Transport

- Carbon Reduction

- Electric Vehicles

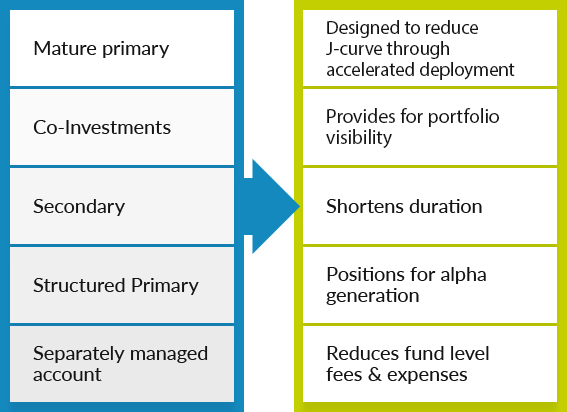

Structured Transactions

In pursuing opportunities alongside the universe of leading GPs, 57 Stars seeks to enhance the probability of outperformance by identifying transactions that have characteristics that include:

- co-investments

- secondary interests

- mature primary fund commitments

- sector- focused primary fund commitments

- structured transactions.

There can be no assurance that 57 Stars will replicate past results or meet its objectives in the future.